ISLAMABAD: The Pakistani government has postponed its decision on privatizing the National Bank of Pakistan (NBP) due to legal complications. This delay contradicts a previous commitment made to the International Monetary Fund (IMF) to remove the special status of seven state-owned companies, including the NBP.

Last month, Pakistan had promised the IMF that it would eliminate the special status of these seven firms. However, the government cited the same special status as the reason for keeping NBP under public ownership. Finance Minister Senator Muhammad Aurangzeb led a meeting of the Cabinet Committee on State-Owned Enterprises (CCoSOEs) to discuss this matter.

According to the Ministry of Finance, "The Cabinet Committee decided that the National Bank of Pakistan, being part of the Sovereign Welfare Fund, is exempt from the SOE Act 2003 and therefore does not need to be categorized."

In addition, the committee resolved to retain the EXIM Bank in the public sector, designating it as a crucial State-Owned Enterprise (SOE). The Pakistan Sovereign Wealth Fund Act exempts companies under its control from the SOE Act of 2023, a regulation established by the World Bank to enhance governance and financial oversight of public-sector firms. Section 50 of this Act provides an exemption for its administered companies.

To reach an agreement with the IMF last month, Pakistan had promised to amend the Pakistan Sovereign Wealth Act to end the special status of NBP and six other profitable entities. The PSWF Act was designed to facilitate the transfer and eventual sale of shares in these companies to raise funds. The entities involved include the Oil and Gas Development Company Limited (OGDCL), Pakistan Petroleum Limited (PPL), Mari Petroleum, NBP, Pakistan Development Fund, Government Holdings (Private) Limited, and Neelum-Jhelum Hydropower Company.

As a significant concession, Pakistan agreed to remove Section 50 from the PSWF Act by December, thereby subjecting these seven firms to the SOE Act 2023. The amended law will ensure that all government-owned entities adhere to the SOE Act and Policy. Pakistan has also committed to revising all relevant sections of the law concerning the objectives, operations, governance, revenue sources, fund withdrawals, and management of public assets within the wealth fund.

Although some CCoSOEs members supported the NBP's privatization, the decision was postponed due to legal issues. The CCoSOEs is now working on categorizing the remaining 61 entities, with non-essential and non-strategic firms scheduled for privatization. The privatization process has faced delays, with missed deadlines for the House Building Finance Company and Pakistan International Airlines. The troubled power sector has been pushed to the second phase of privatization, expected to complete in three years.

Recently, the Cabinet Committee on Privatisation (CCoP) deferred the inclusion of 16 new government-owned enterprises on the active privatization list. The CCoP reaffirmed its decision to privatize 24 enterprises, many of which have been on the list for years.

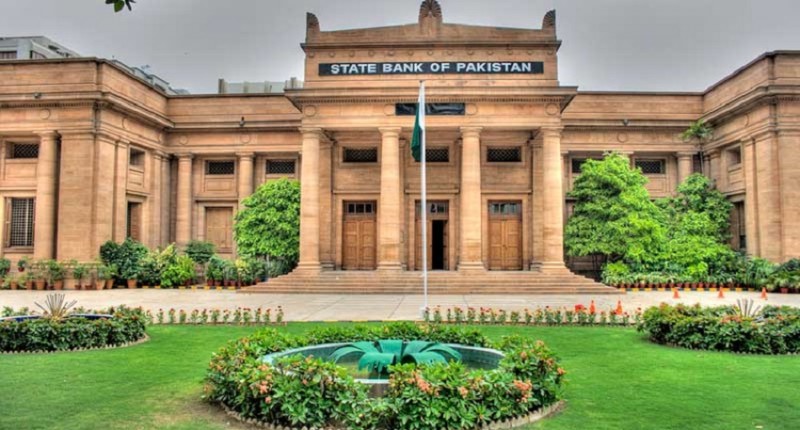

Additionally, the Cabinet Committee on SOEs approved merging the National Security Printing Company (NSPC) with the Pakistan Security Printing Corporation (PSPC). The Ministry of Finance and the State Bank of Pakistan were instructed to finalize the formalities and present an implementation plan. NSPC, which was separated from PSPC, has faced operational issues in printing security documents. The finance ministry will also sell its NSPC stakes to the central bank.

The CCoSOEs has decided that the Zarai Taraqiati Bank Limited (ZTBL) will be privatized, as it was already on the privatization list approved by the CCoP. The committee also noted that the First Women Bank Limited and the House Building Finance Company are at advanced stages of privatization. The finance ministry is also working on liquidating the Industrial Development Bank Limited and winding up the SME Bank.

Currently, the finance ministry oversees about nine companies, with three or four expected to be privatized. However, the operational status of the ZTBL and Exim Bank boards remains uncertain, raising concerns about the ministry's efficiency.